UK SDR: The Future of ESG Reporting Regulation for UK Small-Cap and AIM Companies

The UK Government has released an update on its development of the UK Sustainable Reporting Standards (UK SRS) as part of its Green Financing Roadmap and the Sustainability Disclosure Requirements framework implementation across the UK financial value chain.

To summarise, following an initial consultation, the UK Government has delayed the release of the UK SRS and stated that corporate mandatory reporting would be effective no earlier than accounting periods beginning on or after 1 January 2026.

Here we have summarised the key updates and timelines and what this means for companies now.

The Government framework

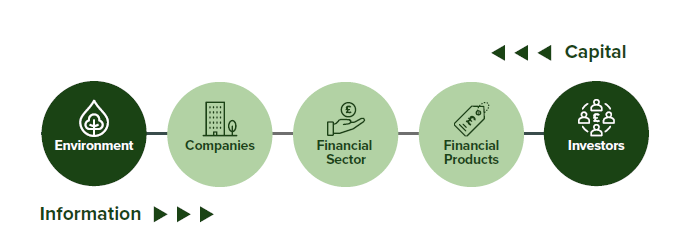

In 2021 the UK Government launched its Green Financing Roadmap, which set out its intentions to develop several initiatives to improve the flow of information from companies through the financial markets to the ultimate asset owners.

Source: UK's Green Financing Roadmap 2021. Although predicated on Environment, "Information" i.e. the disclosure requirements, will also include Social and Governance

The core initiatives for companies within the framework include the development of:

UK Sustainable Reporting Standards (UK SRS). A set of corporate disclosures designed to provide consistent and accurate information to the financial markets on sustainability. The UK SRS is being developed in alignment with the internationally recognised ISSB standards. The ISSB are in the process of developing a global reporting framework, consolidating various other reporting frameworks and standards including TCFD, CSRD, SASB, and aligning to other leading initiatives including CDP and GRI. There is also an ongoing effort to align to the European Sustainability Reporting Standards (ESRS), which are being mandated by the new regulation CSRD that EU countries have until next week to include in law. You can read more about ISSB in our article from last year. At the moment, the ISSB standards give us the best information on what the UK SRS will look like.

Transition Plan Taskforce framework (TPT). Provides best practice for disclosures on how entities will transition to Net Zero. The TPT framework was released in October 2023 and is currently voluntary to report against. The responsibility for maintaining the TPT framework transitioned to the ISSB this month.

UK Taxonomy. An expansion of environmental metrics. The aim of the Taxonomy is to provide consistency and clarity to investors (and ultimately asset owners) in understanding of a company's contribution to environmental sustainability.

The UK Government and FCA are also developing Sustainability Disclosure Requirements (SDR) for financial institutions and products. This aspect of the Green Financing Roadmap is further advanced. The first element went live on 31 May 2024 with the anti-greenwashing rules, investment labelling rules apply from 31 July 2024, and the naming and marketing requirements apply from 2 December 2024. There are plans to consult on broadening the rules to include overseas funds in Q3 2024 and additional disclosures will be phased in over the next two years. We don’t cover these initiatives further in this article.

Updated timelines

UK Sustainable Reporting Standards (UK SRS):

Q1 2025 – UK Government to release the UK SRS (delayed from July 2024)

Q2 2025 – Parallel assessment and mandating reporting requirements: FCA for Main Market and FCA listed firms; and UK Government for all non FCA regulated firms, including AIM firms. Any outcomes will require parliamentary approval.

1 Jan 2026 – Mandatory reporting would be effective no earlier than accounting periods beginning on or after 1 January 2026

Beyond – As the ISSB continues to develop additional standards (it’s currently looking at biodiversity, and human rights for example), the UK Government, via its new Sustainable Disclosure Technical Advisory Committee (TAC), will continue to review and update the UK SRS in alignment. The TAC also plays a role in developing the ISSB standards.

Transition Plans:

"Shortly" - consultation on how companies can most effectively disclose their Transition Plans; initially expected in autumn 2023.

UK Taxonomy:

"Shortly" - the government will mobilise a consultation process on the UK Taxonomy. Any requirements will be test run for 2 years before mandating its use.

What do we know about the future regulations?

Although the specific requirements of the UK SRS are not yet finalised, there are some clear indications of what is to come for firms.

What companies will be required to report?

The corporate disclosures will be based on the ISSB’s IFRS S1 and S2 standards which are currently available for voluntary disclosures.

The standards follow the same framework as used in TCFD and hence will be familiar to many:

o Governance – board and management roles and responsibilities in sustainability risks and opportunity oversight

o Strategy – what are the key sustainable risks and opportunities that firms face, what does this mean to the long-term value of the firm and the robustness of its strategy

o Risk Management – how are risks and opportunities identified and managed

o Metrics and Targets – what data are companies using to monitor their risks and opportunities, and what commitments and goals is it setting to demonstrate its ambition

IFRS S2 covers the TCFD (Taskforce for Climate-related Financial Disclosures) requirements and as such we expect the TCFD and Climate-Related Reporting regulations to be eclipsed by the UK SRS.

IFRS S2 requires reporting a full carbon footprint, requiring firms to consider all 15 Scope 3 (value chain) categories for reporting. If the UK SRS aligns fully to IFRS S2, then this will be a significant evolution on the current SECR and Climate-related reporting regulations for AIM quoted firms who are only required to report Scope 1, 2, and Grey Fleet energy and emissions today. For main market firms, required to report against the full TCFD framework, should already be reporting significant Scope 3 emissions, although Addidat's proprietary data shows many firms are yet to.

Transition Plan reporting. IFRS S2 includes the requirement to disclose a Net Zero Transition Plan if one has been developed and has recently taken on the oversight and maintenance of the TPT framework. The UK Government has been a driving force behind the development of the TPT framework and thus we expect it to form part of the UK SRS. The FCA has also stated its intentions to strengthen Transition Plan disclosures.

Nature related reporting. Although the government has previously stated its support of the TNFD (Taskforce for Nature Related Disclosures) it has not made any further commitments to mandating reporting on nature. It is likely that it will wait for the ISSB to release its specific Nature standards, which is work in progress, and embed into the UK SRS at a later date.

UK Taxonomy will help to form the basis for the metrics that companies (and in turn their investors) will need to report on to demonstrate how a company attributes to environmental sustainability. We hope the UK Government can provide clarity on the requirements before the UK SRS are finalised, or at least before reporting deadlines approach, as the potential to move the goalposts on data is inefficient and could be costly for firms if they need to adjust the metrics they are calculating, monitoring and reporting.

Who will be required to report?

This remains unclear. We believe the government's intention is that these disclosure requirements will be wide reaching, and likely impact all companies with a public interest at some stage. We would assume incoming requirements will be phased dependent on size. The concurrent government review of non-financial reporting requirements (which considers if current company size thresholds (micro, small, medium and large) are fit for purpose) is due to update in August. This might provide more clarity here.

What should firms be doing now?

Although companies will not be mandated to start reporting on the UK SRS until 2026 at the earliest, there are many reasons companies need be thinking about this regulatory trend as they continue to invest in their ESG strategies.

Don't let the tail wag the dog. Firms who wait for ESG reporting regulation to drive their sustainability actions rarely end up with the right answer for the firm. It will be a more stressful experience for the firm's leadership and board, as well as be more expensive in the long run. ESG reporting should reflect the company's strategic ESG ambition - focused on areas that enable the long-term growth and success of the firm. It should not drive what ESG initiatives they undertake.

Think Big, Start Small, Scale Steadily. Our mantra for successful Corporate Responsibility and Sustainability Strategies. Scaling Steadily is particularly important for smaller, growing firms who have limited bandwidth to progress these initiatives. But the Thinking Big requires understanding the the key threats and opportunities, like these future reporting requirements, to ensure any scaling is in the right direction. This is particularly important for multi-jurisdictional companies who may also need to consider other regional regulatory trends and requirements. Although there is alignment across the initiatives, there are differences and these will be best managed if understood upfront.

It's not a case of if, but when. All firms should prepare to expand on their ESG disclosures over the coming years and should plan for the additional capital investment needed to support these. The frameworks that the UK SDS will be based on, are considered best practice. Any investment in an ESG reporting strategy should be aligned to these anyway, and any progress made against the disclosures now will minimise the impact and disruption of any regulation when it comes.

Get on the data front foot. Collecting data for the first time in 2026 specifically to meet regulatory requirements will be a lot more stressful that it needs to. Anticipating data collection requirements, and putting in place a scalable process, in line with your strategy will pay dividends when UK SRS requirements hit.

Addidat exists to help our clients navigate the increasingly complex Corporate Responsibility and Sustainability and ESG landscapes as internal and external pressures grow. We use a data-informed approach to our Advisory Services and, also, make this proprietary data available via The Addidat Platform.

Our experts help you navigate the challenges and opportunities that Corporate Responsibility and Sustainability and ESG presents by designing and embedding right-sized solutions within your business.

Please contact Beth Scaysbrook if you'd like to hear more about what we're seeing in the market and how we help the AIM and small-cap communities succeed in ESG with our market leading advice and data.

Key resources

UK Government Key Documents

Latest update from the UK Government on UK SDR

Framework for Developing UK Sustainability Reporting Standards

Green Financing: : A roadmap to sustainable investing - 2021

2023 update to the Green Financing Roadmap

Other useful resources

Addidat is a QCA code verified organisation. Purchase the full QCA code from the QCA’s website.

To discuss further, please get in touch with the team.

Never miss an update from Addidat. Subscribe to our monthly Newsletter by following this link.